Q&A

Some questions you may have

Key Questions

When you purchase from cidi you are purchasing three things, a motorcycle, the motorcycle leasing service from cidi and the guarantee that we will repurchase the motorcycle at a higher price after a year.

But what does it mean really? It means that you give us the authority to use the proceeds of your purchase to buy a motorcycle and to lease it to a driver to run a taxi-motorcycle business. It also means that we have the obligation to buy back the motorcycle at 110% of the purchase value after one year.

cidi builds an alternative to public transport that employs millions of individual entrepreneurs in countries that lack public transport. cidi works with affiliates and local motorcycle financing companies that manage all aspects of Leasing the motorcycle to drivers. The companies we work with are carefully selected, we go through a screening process that takes months to understand their business, how they do things, how they appraise the borrowers and manage the collections. We then spend time defining agreements that are coherent with our practice of secured asset financing.

All our motorcycle financings are backed by security. Before committing to financing a motorcycle we examine the creditworthiness of the borrower, the viability of the borrower’s repayment ability, his aptitude to undertake the motorcycle business. Each borrower must also provide a deposit for up to 30% of the value of the motorcycle and have guarantors that stand in his stead should he not repay. We give great attention to making sure our security by having direct claims on motorcycle ownership. This, together with our diligent internal processes, ensures that security risk is minimized. Our Buyers whilst buying a single motorcycle are not presented with the risk of Individual defaults, that is if a borrower does not repay his motorcycle, our buy-back obligation stands.

We increase the driver’s odds of success by helping drivers access Motorcycle ownership, plugging the drivers into ride hailing networks, and helping them to comply with security standards, training and insurance requirements.

It is more likely the drivers has real problems that may affect his ability to earn and repay. It is best in these situations to work towards an arrangement. In the rare occasions where the driver intends not to honour his obligations, cidi has the right of repossession. The Motorcycle can either leased to an alternative driver or sold.

cidi Limited is a UK incorporated Limited Company. We are currently active in Kenya because it has a large population of 50 million, but has an absence of formal public transport options.

How cidi works

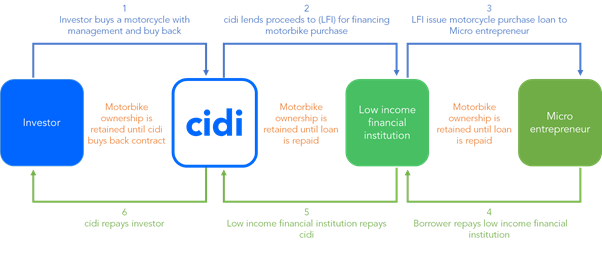

cidi’s lending We finance affiliates and motorcycle financing companies that lease the motorcycle to individual drivers but create a direct link with the motorcycle by holding the motorcycles in our names. The driver will have a loan contract with the LFI but the motorcycle assets will be held by us alongside the right to the loan cash flows in case the affiliate or the partner defaults.

Yes, once the motorcycle are registered you will be a joint tenant, meaning you will have joint ownership with cidi of a motorcycle. Please refer to our Conditions of Sale for more information

No. The Motorcycle will be allocated to a selected driver to run their own taxi service in Kenya. Once you have purchased the Motorcycle, it can take up to three weeks to be allocated to the driver, and thereafter be legally registered.

The Motorcycles are produced by multinationals such as Bajaj and Honda. They are sold exclusively by dealers in the countries in which we operate.

Investing with cidi

In order to buy a motorcycle from cidi an individual must be at least 18 years or buy through a legal entity.

Purchase a Bike Purchase a motorcycle at checkout with you credit card or through a bank transfer. The purchase contract and the receipt of purchase complete the legal agreement between You and cidi

Earn profit Through affiliated companies or through local motorcycle financing companies that specialise in leasing motorcycles we screen individuals entrepreneurs that are interested in leasing motorcycles to undertake a transport business. Once we have sorted out the lease agreements with the borrower we purchase the motorcycle at a dealer and avail it to the driver to begin running his business. The driver makes periodic repayments tour affiliates or local motorcycle financing companies.

After a year the value of the lease is repaid. We return to your account the value of your purchase plus your 10% return. Ownership of the motorcycle is then transferred to the driver.

cidi does not charge Buyers any fees. cidi makes its profit from the spread between the interest rate charged to borrowers and the return offered to buyers.

You can purchase in euro (EUR)

cidi accepts all currencies. Payments received in currencies other than EUR will be converted to EUR.

The time depends on the commercial bank and currency of your country. For EUR currency it usually takes 1 working day, but for other currencies it can take up to 2 working days.

You are welcome to contact cidi support team at info@cidi.group

The purchase contract

The buyback provision in the purchase contract guarantees that cidi will buy back the motorcycle at 110% of the purchase price. The purchase contract is enforceable but realistically if we opposed your rights to the contract you would need to enforce this through an injunction.

We partner with motorcycle financing companies who become a party to the obligation

We finance the motorcycles in partnership with specialised motorcycle financing companies (LFIs) that have experience in dealing with individual micro loans and that support cidi in managing the financing to the drivers. To avoid agency risk (the fact that the agent does not have a vested interest in resolving an issue that pertains to the owner), we issue the motorcycle finance loan to the LFI which acts as the counterparty to our transaction. This means that the LFI is the one who needs to replay cidi and you in FULL for the amount of the financing and interest regardless of potential delinquencies linked to any single or group of motorcycles. This aligns the LFI’s interest with ours, especially when it comes to managing delinquent loans. The LFI’s we partner with have next to zero defaults because they manage well delinquent situations, seize the motorcycles and re-introduce them to new borrowers that may be interested in motorcycles.

When we lend to the LFI we take security on the LFI loan book over and above the value of our loan, typically 130%. This means that our €100 loan is covered to the tune of €130 by the value of the motorcycles and the LFI’s loan book.

cidi maintains ownership of the vehicle until the loan is repaid. We keep ownership of the motorcycles because in case of non-repayment by the LFI we can seize and dispose of our security (the motorcycles) without having to undertake legal proceedings.

Again our partners have 0% default rates towards their lenders and less than 1% default rates in their loan book.

Regular repayments and monitoring

We receive monthly repayments of interest from the LFI and monitor the LFI finances regularly.

Every motorcycle financing is secured against the motorcycle. This means that if the borrower fails to repay, we would repossess the motorcycle and lease it out to another driver or sell it. Sometimes, borrowers require some flexibility. For example, they might warn us of an issue that could make them late on a payment. If having assessed the facts and the evidence provided to us, we are comfortable with the delay, we may allow the borrower to defer payment to a later date. Furthermore, our Buyers if buying a single motorcycle are not presented with the risk of individual defaults, that is if a borrower does not repay his motorcycle, our buy-back obligation stands.

Once the motorcycle is allocated we will tell you who your motorcycle has been allocated to and tell you who the driver is and how the Mabout the driver.

The quality of the entrepreneur

The borrower needs to be fit for being a Taxi driver and goes through a screening process undertaken by the LFI which we have vetted. This includes the right risk profile, the right collateral, a guarantor, the correct licenses, etc…

The target demographics

We also take care of making sure that the driver belongs to the target demographic we seek to empower. For example, there are instances of high-income individuals that leverage up to acquire motorcycle assets to rent them to drivers. Because we are particularly sensitive to the usury that often takes place in these situations that represent unfortunately the bulk of the taxis in this sector we check that they correspond to the demographic we seek to help through residential address checks and /or credit bureau checks.

Yes Motorcycles have retail values of roughly 70% after a year. Estimates indicate that there are at any given time in a city like Nairobi thousands of second hand Motorcycles available for sale.

The market

We have run surveys independently to corroborate what is said in sector reports, what LFI’s say and what is heard in the media regarding the earnings of Boda drivers. These will vary according to city, area, and regions but all in all we see that the demand is strong, and they all earn between $5-$12/day income. Drivers typically get hailed in the street by passengers, they are rarely contracted out except in the case of parcels and goods delivery which is a fast-growing market in Kenya.

Anecdotal data indicates that the drivers that fail do so not due to a lack of demand but often from poor personal choices in how they conduct their business and exogenous factors such as accidents or thefts. The insurance covers well the latter whilst the former are greatly helped through training or membership within networks.

Uber says…

Uber is expanding its technological footprint in the Kenya Boda market, introducing e-hailing. I have been to an Uber recruitment event when they onboard driver onto the platform and they indicate clearly to drivers even higher income ranges if they join. Part of the support we want to provide is to insert all our drivers to the e-hailing networks to increase their resilience.

Credit checks

Drivers are run through credit checks. This involves an identity check, financial screening, securing guarantors for the loan and much more. The credit checks are run by our partners or our affiliates.

Aptitude checks

There is a basic aptitude check to verify previous professional experience, training the drivers have undertaken, driving skills and other aptitudinal assessments during the screening process.

Complementing the credit checks The partners and affiliates we work with go beyond office checks and visit the areas where the drivers live; ask for reputational checks from trade shops in the area; organise groups that agree to vet and guarantee drivers they introduce. These practices tend to result in better credit decisions.

cidi strategy for value addition We offer further support to our drivers including encouraging training; enforcing insurance; enforcing safety standards such as protective gear and inserting the drivers in ride-hailing networks such as Uber that tend to deliver increased daily income. These are small, easy to enforce measures that increase substantially the driver’s success odd and reduces our risk.

Servicing the loans Our partners and affiliates have well-run systems to manage their loans. Payments are all made through digital currency. They receive daily or weekly repayments that are reconciled through proprietary or cloud-based loan management systems. These systems typically help manage the full loan cycle from origination to recovery and bookkeeping but they all are effective at helping with the repayments and the management of the loans. Our partners and affiliates are very apt at servicing their client base and at managing delinquent borrowers.

Uk common law The enforceability of the condition of purchase agreement will be under the framework of UK law. You will have the right to seek legal action against cidi for not honouring the buyback provision, to enforce a sale of our assets (the motorcycles) to get compensation and to seek damages and legal fees reimbursed in case we challenge your legal claim and are forced to pay by the court.

The profit acquired through cidi motorcycle purchase contract is not subject to tax as it is a sale of a personal effect. Buyers must themselves verify income tax laws applicable in the respective country where the Buyer is a tax resident.

The repayment The repayments are going to be done through bank transfer with a bullet repayment of principal plus return. Transaction costs of monthly or quarterly repayments would eat in the return given the unit size of the investment.

Flexibility Buyers considering multiple units have enquired about flexibility regarding repayment, we will consider these.

How we change the world

By buying a Motorcycle you will impact families and whole communities supporting a business that pays on average $10 or 5 times the national poverty threshold of $2 a day. Through their work drivers are able to meet the livelihood needs of their families, allowing them to better support entire households.

Drivers display much greater upward social mobility than adjacent industries, due to the fact that they are their own bosses, and get to keep the majority of the income earned by them.

On average less than 18 months.